Navigating the Digital Landscape: Understanding Online Job KYC & Tax Forms

Related Articles: Navigating the Digital Landscape: Understanding Online Job KYC & Tax Forms

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Digital Landscape: Understanding Online Job KYC & Tax Forms. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Digital Landscape: Understanding Online Job KYC & Tax Forms

In the contemporary digital economy, where remote work and online platforms are increasingly prevalent, the process of verifying identity and managing tax obligations has taken on new dimensions. This necessitates a comprehensive understanding of the crucial role played by Know Your Customer (KYC) procedures and tax forms in the online job landscape.

Know Your Customer (KYC) in the Online Job Market

KYC, a fundamental pillar of regulatory compliance and risk mitigation, is essential for online platforms and businesses that operate in the digital realm. In the context of online jobs, KYC procedures are vital for ensuring the security and integrity of both the platform and its users.

Why is KYC Crucial for Online Job Platforms?

-

Preventing Fraud and Identity Theft: KYC helps online platforms identify and verify the authenticity of users, mitigating the risk of fraudulent activities, such as identity theft and impersonation. By verifying identity documents, platforms can reduce the likelihood of individuals creating fake profiles or engaging in illicit activities.

-

Ensuring Financial Security: KYC procedures play a crucial role in safeguarding financial transactions. By verifying the identity of users, platforms can mitigate the risk of money laundering and other financial crimes, protecting both the platform and its users from financial losses.

-

Building Trust and Reputation: Implementing robust KYC processes fosters trust and confidence among users. By demonstrating a commitment to security and compliance, online job platforms enhance their reputation and attract a wider range of legitimate users.

-

Compliance with Regulatory Requirements: KYC is mandated by various regulatory bodies worldwide to combat financial crime and protect consumers. Online platforms must adhere to these regulations to operate legally and avoid penalties.

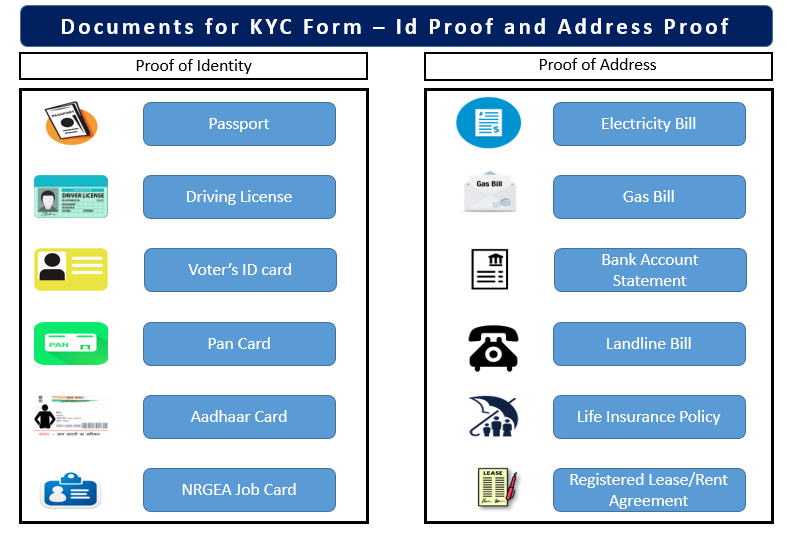

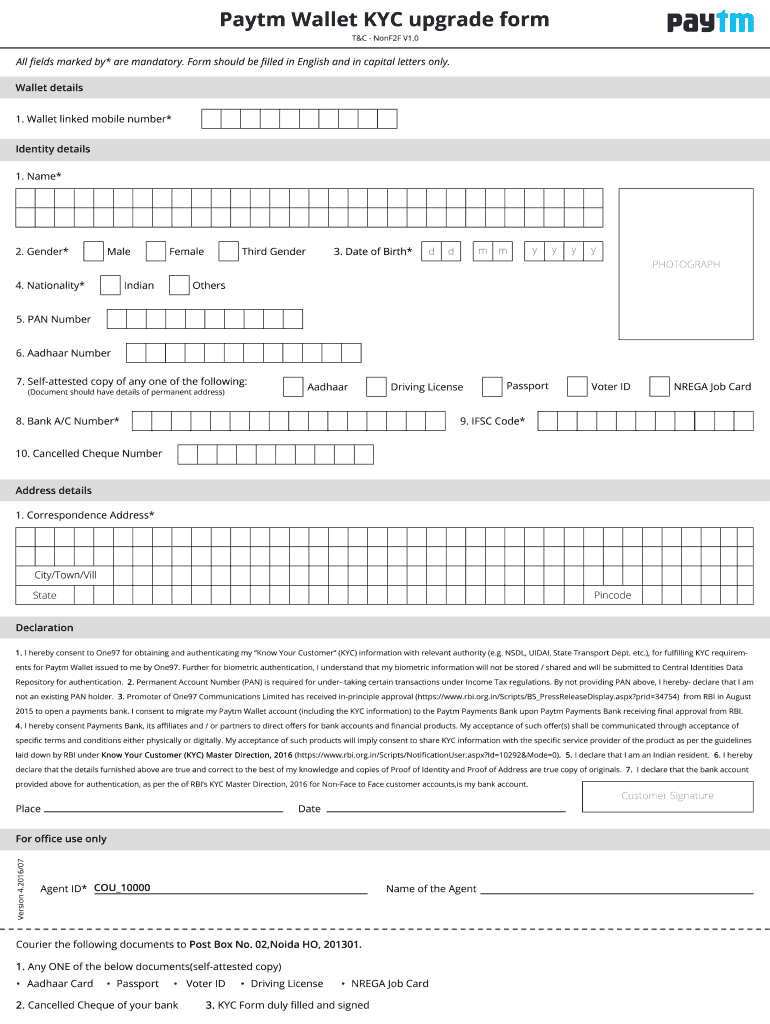

Types of KYC Documents Typically Required for Online Jobs

The specific KYC documents required may vary depending on the platform and the nature of the job. However, common documents include:

- Proof of Identity: Government-issued identification cards, such as driver’s licenses, passports, or national identity cards.

- Proof of Address: Utility bills, bank statements, or other documents that verify the user’s residential address.

- Tax Identification Number (TIN): This number, unique to each individual, is used for tax purposes and helps verify the user’s identity.

The Importance of Tax Forms in Online Jobs

Tax compliance is a crucial aspect of online employment, as individuals are responsible for paying taxes on their earnings. Online job platforms often facilitate the process of tax reporting by providing users with necessary tax forms and guidance.

Understanding the Purpose of Tax Forms in Online Jobs

-

Reporting Income and Deductions: Tax forms enable individuals to report their income earned from online jobs and claim any eligible deductions. This information is used by tax authorities to calculate the individual’s tax liability.

-

Ensuring Accurate Tax Payments: By accurately reporting income and deductions, individuals can ensure they pay the correct amount of taxes, avoiding penalties and potential legal issues.

-

Facilitating Tax Refunds: In some cases, individuals may be eligible for tax refunds if they have overpaid taxes. Tax forms provide the necessary information for claiming these refunds.

-

Maintaining Financial Transparency: Tax forms contribute to maintaining financial transparency in the online job market, ensuring that individuals are accountable for their earnings and tax obligations.

Common Tax Forms Used in Online Jobs

- 1099-NEC (Non-Employee Compensation): This form is used to report income earned from independent contractors, freelancers, and other self-employed individuals.

- W-2 (Wage and Tax Statement): This form is used to report income earned from traditional employment, including online jobs that involve a formal employer-employee relationship.

- 1040 (U.S. Individual Income Tax Return): This form is used to file individual income taxes, including income earned from online jobs.

Navigating the Process of KYC & Tax Forms in Online Jobs

-

Thoroughly Review Platform Requirements: Before signing up for an online job platform, carefully review the platform’s KYC and tax form requirements. This includes understanding the documents needed, the process for submitting them, and any associated deadlines.

-

Gather Necessary Documents: Ensure you have all the required documents, such as proof of identity, proof of address, and tax identification number, ready for submission.

-

Complete Forms Accurately and Timely: Complete all required forms accurately and submit them within the designated deadlines. Errors or delays can lead to penalties or complications.

-

Seek Professional Assistance When Needed: If you have any questions or require assistance with KYC or tax form procedures, do not hesitate to seek help from a tax professional or the platform’s customer support team.

FAQs Regarding Online Job KYC & Tax Forms

Q: What happens if I fail to provide KYC documents or complete tax forms?

A: Failure to comply with KYC requirements or submit necessary tax forms can result in various consequences, including:

- Account Suspension or Termination: Platforms may suspend or terminate accounts that fail to meet KYC requirements.

- Inability to Receive Payments: Platforms may withhold payments until KYC requirements are met.

- Tax Penalties: Individuals may face tax penalties for failing to file tax returns or report income accurately.

Q: Are my personal details safe with online job platforms?

A: Reputable online job platforms prioritize data security and privacy. They typically employ robust security measures to protect user information, such as encryption and secure data storage. However, it’s essential to choose platforms with a proven track record of security and privacy practices.

Q: Can I use a virtual address for KYC purposes?

A: Some platforms may accept virtual addresses for KYC verification, while others may require a physical address. Check the platform’s specific requirements.

Q: What if I am an international user working on an online job platform?

A: International users may face additional KYC and tax compliance requirements. It’s essential to understand the specific regulations in your country of residence and the platform’s policies for international users.

Tips for Managing KYC and Tax Forms in Online Jobs

- Maintain a Dedicated Folder: Create a dedicated folder on your computer or in cloud storage to store all relevant KYC documents and tax forms.

- Keep Track of Deadlines: Set reminders for important deadlines related to KYC verification and tax filing.

- Communicate with Platforms: If you have any questions or concerns about KYC or tax forms, contact the platform’s customer support team for assistance.

- Seek Professional Advice: Consult with a tax professional or financial advisor for guidance on tax compliance and reporting.

Conclusion

Understanding the importance of KYC and tax forms in online jobs is crucial for both individual users and online platforms. By complying with KYC requirements and accurately completing tax forms, individuals can ensure their financial security, maintain their reputation, and avoid potential legal issues. Online platforms, in turn, can build trust, mitigate risk, and operate in a legally compliant manner. The digital landscape of online work necessitates a comprehensive understanding of these procedures, ensuring a secure and transparent environment for all stakeholders.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Digital Landscape: Understanding Online Job KYC & Tax Forms. We thank you for taking the time to read this article. See you in our next article!