The Landscape of Mobile Money Charges in Ghana: A Comprehensive Guide

Related Articles: The Landscape of Mobile Money Charges in Ghana: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Landscape of Mobile Money Charges in Ghana: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Landscape of Mobile Money Charges in Ghana: A Comprehensive Guide

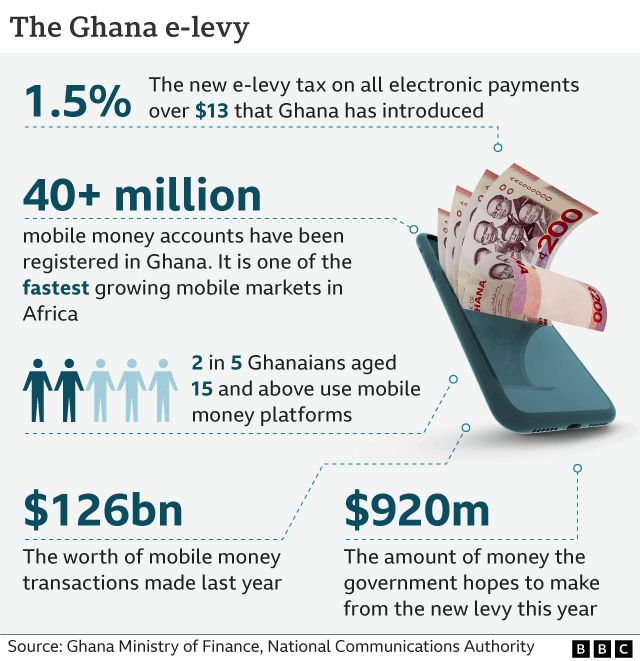

Mobile money, or "Momo" as it is affectionately known in Ghana, has revolutionized financial transactions in the country. Its widespread adoption, particularly in a nation with a relatively low bank penetration rate, has significantly enhanced access to financial services for millions of Ghanaians. However, understanding the intricacies of mobile money charges is crucial for users to maximize the benefits and navigate the system effectively. This article delves into the various fees associated with mobile money transactions in Ghana, offering a comprehensive overview and exploring its significance within the broader financial ecosystem.

Understanding the Charges:

Mobile money charges in Ghana are generally determined by the Mobile Network Operator (MNO) providing the service. These charges are typically applied to various transaction types, including:

- Cash-in: Fees charged when depositing cash into a mobile money wallet.

- Cash-out: Fees incurred when withdrawing funds from a mobile money wallet.

- Peer-to-peer (P2P) Transfers: Charges levied on sending money to another mobile money account.

- Merchant Payments: Fees charged for making payments to businesses using mobile money.

- Airtime Top-up: Fees associated with purchasing airtime for mobile phones.

- Bill Payments: Charges for paying utility bills or other services through mobile money.

Factors Influencing Mobile Money Charges:

Several factors influence the charges levied on mobile money transactions. These include:

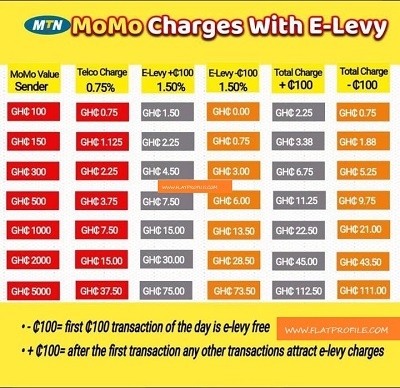

- Transaction Amount: Larger transaction amounts generally attract higher fees.

- Transaction Type: Different transaction types often carry varying charges.

- Network Provider: Each MNO sets its own fee structure.

- Promotional Offers: Operators may introduce temporary promotional offers that waive or reduce charges.

- Regulatory Measures: The Bank of Ghana (BoG) plays a regulatory role in ensuring fair and transparent mobile money charges.

Benefits of Mobile Money Charges:

While charges may seem like an added expense, they play a crucial role in supporting the mobile money ecosystem. These charges:

- Cover Operational Costs: They contribute to the operational costs associated with maintaining the mobile money platform, including infrastructure, customer support, and security measures.

- Incentivize Usage: Strategic pricing strategies can encourage users to opt for specific transaction types, promoting greater adoption of mobile money services.

- Promote Financial Inclusion: By ensuring the sustainability of mobile money platforms, charges contribute to wider financial inclusion, empowering individuals with limited access to traditional banking services.

Navigating the Charges Effectively:

Consumers can navigate the mobile money landscape more effectively by:

- Comparing Charges: Scrutinizing the fee structures of different MNOs to identify the most cost-effective options for their specific needs.

- Utilizing Promotional Offers: Taking advantage of temporary promotional offers or discounts to minimize transaction costs.

- Understanding Transaction Types: Being aware of the different transaction types and their associated charges to make informed decisions.

- Exploring Alternative Options: Considering alternative payment methods, such as bank transfers or debit card payments, when applicable.

FAQs on Mobile Money Charges in Ghana:

1. Are mobile money charges standardized across all networks?

No, mobile money charges are not standardized across all networks. Each MNO sets its own fee structure, which can vary significantly.

2. How can I find out the charges for a specific transaction?

Most MNOs provide detailed information on their mobile money charges on their websites or through their customer service channels.

3. Are there any hidden charges associated with mobile money?

While most charges are transparently communicated, it is crucial to carefully review the terms and conditions associated with mobile money services to avoid any unexpected charges.

4. Can I negotiate mobile money charges?

Negotiating mobile money charges is typically not possible for individual consumers. However, businesses or organizations may be able to negotiate bulk discounts with MNOs.

5. How can I avoid high mobile money charges?

By comparing charges, utilizing promotional offers, and exploring alternative payment methods, individuals can minimize their mobile money expenses.

Tips for Managing Mobile Money Charges:

- Plan your transactions: Plan your mobile money transactions in advance to minimize the number of individual transactions and associated charges.

- Utilize large transactions: For significant amounts, consider making a single large transaction to benefit from potentially lower charges per unit.

- Leverage loyalty programs: Take advantage of loyalty programs or rewards schemes offered by MNOs to earn discounts or cashback on mobile money transactions.

- Stay informed about updates: Keep abreast of any changes in mobile money charges or new promotional offers announced by MNOs.

Conclusion:

Mobile money charges in Ghana play a crucial role in sustaining the growth and accessibility of this transformative financial service. While charges may seem like an added expense, they are essential for maintaining the operational efficiency and security of the mobile money ecosystem. By understanding the factors influencing charges and adopting effective strategies for managing them, consumers can maximize the benefits of mobile money while minimizing their expenses. As mobile money continues to evolve in Ghana, the transparency and fairness of charges will remain paramount in fostering its continued success and ensuring its accessibility to all segments of the population.

![MTN Mobile Money Charges in Ghana [2024]](https://asetenapa.com/wp-content/uploads/2024/04/mtn-mobile-money-charges.png)

Closure

Thus, we hope this article has provided valuable insights into The Landscape of Mobile Money Charges in Ghana: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!